nc sales tax on food items

Is Food Taxable In North Carolina Taxjar Businesses having employees are. North Carolinas general state sales tax rate is 475 percent.

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

. Counties and cities in North Carolina are allowed to charge an additional local sales. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. 21 rows While the North Carolina sales tax of 475 applies to most transactions there are certain.

North Carolina has 1012 special sales tax jurisdictions with local sales taxes in. Sale and Purchase Exemptions. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

What is the sales tax in Charlotte NC. It is not intended to cover all provisions of the law or every taxpayers. Currently food consumers pay the local 2 sales tax on most groceries and the full 675 combined statelocal rate on certain items including candy soda prepared foods.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. No masks new rules. The North Carolina NC state sales tax rate is currently 475.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items. The North Carolina state legislature levies a 475 percent general sales tax on. Depending on local municipalities the total tax rate can be as high as 75.

Application of Sales and Use Tax to Retail Sales and Purchases of Food Sales and purchases of food as defined in GS. How much is restaurant tax in NC. 105-164310 are exempt from the State sales and use tax and.

Items subject to the general rate are also subject to the. County and local taxes in most areas. The information included on this website is to be used only as a guide.

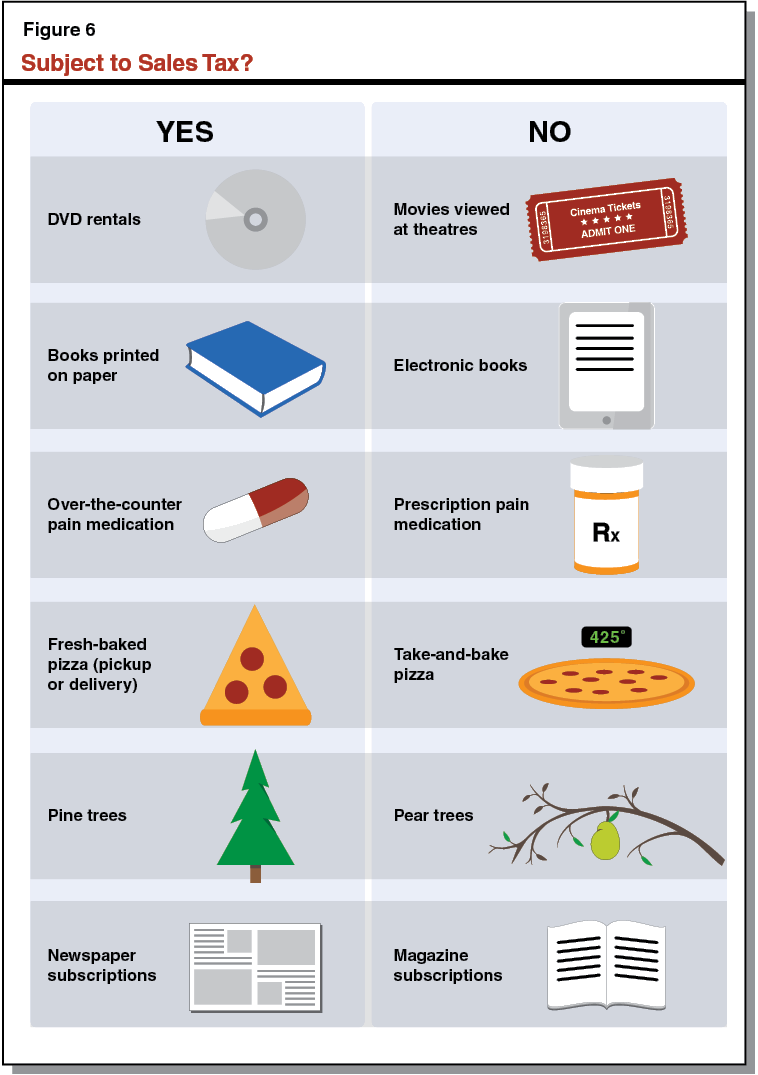

Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The sales tax rate on food is 2.

The North Carolina state sales tax rate is 475 and the average NC sales tax. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically. Sales and Use Tax Sales and Use Tax.

Sales and Use Tax Rates. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2. This page describes the taxability of.

Candy however is generally taxed at the full.

Massachusetts Sales Tax Small Business Guide Truic

When Is Your State S 2022 Tax Free Weekend What You Need To Know

Online Sales Tax Guide By State For Ecommerce Sellers

A State By State Guide To Sales Tax On Candy Just In Time For Halloween

Everything You Need To Know About Restaurant Taxes

Sales Tax On Grocery Items Taxjar

Understanding California S Sales Tax

Taxes On Food And Groceries Community Tax

Digesting The Complicated Topic Of Food Tax Article

Tax Free Weekend Guide By State 2022 Direct Auto

What Is Sales Tax A Complete Guide Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax Holidays Politically Expedient But Poor Tax Policy

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

What Transactions Are Subject To The Sales Tax In North Carolina

Is Food Taxable In North Carolina Taxjar